Setting Up And Running An SMSF

Setting up an SMSF

- Choosing a name for the fund, who the members will be up to a maximum of six, and whether the members or a company will act as trustee for the fund.

- If a company will act as trustee, which is the best option, the directors must apply for a director ID if they don’t already have one.

- Have the trust deed drawn up.

- Sign trustee declarations within 21 days of becoming a trustee.

- Elect to be a regulated SMSF.

- Apply for a TFN and ABN, and register for GST if applicable.

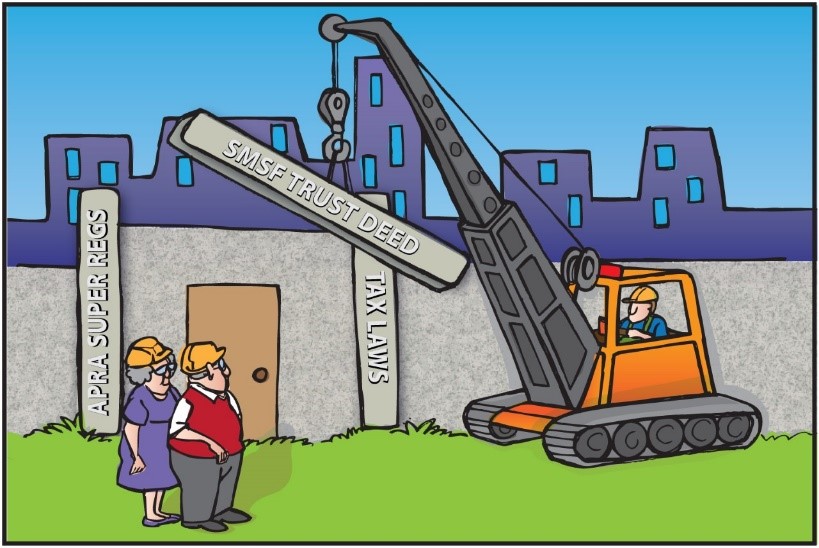

Running an SMSF

As superannuation is all about providing an income for members when they retire, a self managed super fund is all about the members having control and looking after their own retirement.

One of the earliest forms of superannuation, and an example of the first SMSFS, was devised by the ancient Romans. They recognised that once their soldiers could no longer fight they had the choice of leaving them to their own devices, which often resulted in lawlessness and banditry, or they could grant them parcels of land in conquered parts of the empire where they could provide for their own retirement.

Trustee/members of an SMSF have a lot in common with those soldiers of ancient Rome. The running and success of an SMSF, including all the responsibility, sits firmly on the shoulders of the trustees of the fund. They include once the fund has been set up and registered as a complying fund with the ATO:

- Open a bank account (or a number of accounts).

- Decide on an investment strategy.

- Put in place administration and accounting systems.

- Receive contributions and rollovers within the regulations.

- Invest monies received

- Appoint an auditor

The amount of administration that is required by trustees of an SMSFs can sometimes leave the members feeling as though they are drowning in paperwork. Unlike ancient Roman soldiers that had total responsibility for maintaining their patch of land and their life in retirement, trustees of an SMSFs can do as much or as little of the work as they want.

TaxBiz Australia not only assists with deciding whether an SMSF is the best vehicle for providing an income in retirement, but we also assist in the setting up and administering the fund.

Go to our services page for more details.