Motor Vehicles

Maximising Tax Deductions for Motor Vehicles

The Kilometre Method

Under the kilometre method the tax deduction is calculated by multiplying the business kilometres, up to a maximum of 5000 a year, by a cents per kilometre rate.

No documentation needs to be kept to prove the number of kilometres claimed. You must however be able to show how you estimated the distance travelled in a reasonable way.

The rates have changed over the years from differing depending on the engine size of the vehicle, to now there being one rate for all vehicles that can change from year to year.

Kilometre rate for the 2023 in the 2024 years is 85 cents.

Where two or more cars are owned in a year and used for business purposes a tax deduction can be claimed for each of the cars using this method.

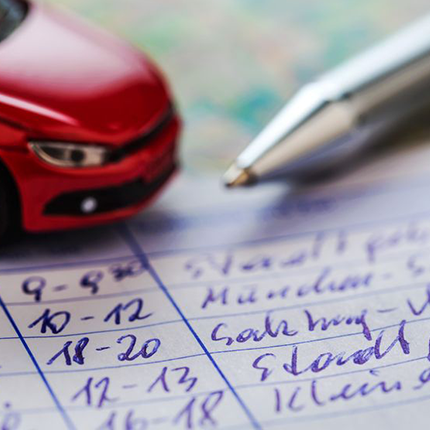

The Log Book Method

The costs included for a motor vehicle are:

- The day the journey began and ended,

- The odometer reading at start and end of the journey,

- The length of the journey in kilometres, and

- The reason for the journey.

- When the log book period begins and ends,

- The odometer readings at the beginning and end of the log book period,

- The total number of kilometres travelled during log book period,

- The number of kilometres travelled on business, and

- The percentage that business kilometres were of the total kilometres travelled.

- Fuel

- Repairs and maintenance

- Registration and insurance

- Depreciation of the cost of the vehicle

- Finance cost on purchasing the vehicle

If you want to know how to maximise your tax deduction for motor vehicle costs Contact Us at TaxBiz Australia.