Resources and Our Services

TAX AND ACCOUNTING SERVICES

TaxBiz Australia provides the full complement of tax and accounting services assisting everyone from individuals and couples, that are either employed, business owners, or investors, to all of the different tax structures including partnerships, family discretionary trusts, unit trusts, and companies.

The fees charged are not based on what we think a client can afford, but based on the time it takes to do the work, at an hourly rate that depends on the qualifications and experience of the team member.

We do offer businesses, that want to agree a fee for a 12 month engagement, that encompasses all of the tax and other compliance work, lodging BAS returns, finalising the annual financial statements, and all other matters relating to meeting their obligations to the ATO.

TaxBiz Australia has grown over the years due to focusing on clients, regarding them as people rather than tax returns or financial statements. We also make sure that the three most common complaints about accountants:

the three most common complaints about accountants:

- I can never get them when I want them,

- They never return phone calls, and

- They never make suggestions on how I can improve things. Does not apply to us.

SUPERANNUATION AND SERVICES

the financial services section of TaxBiz Australia we can:

- Provide tax planning advice for your journey to retirement maximising your income while at the same time reducing the tax you pay.

- Assist in choosing the best industry super fund using an independent rating agency.

- Provide advice on which of the investment choices available through an industry super fund maximises your income while at the same time reducing a loss in the value of your superannuation when markets crash.

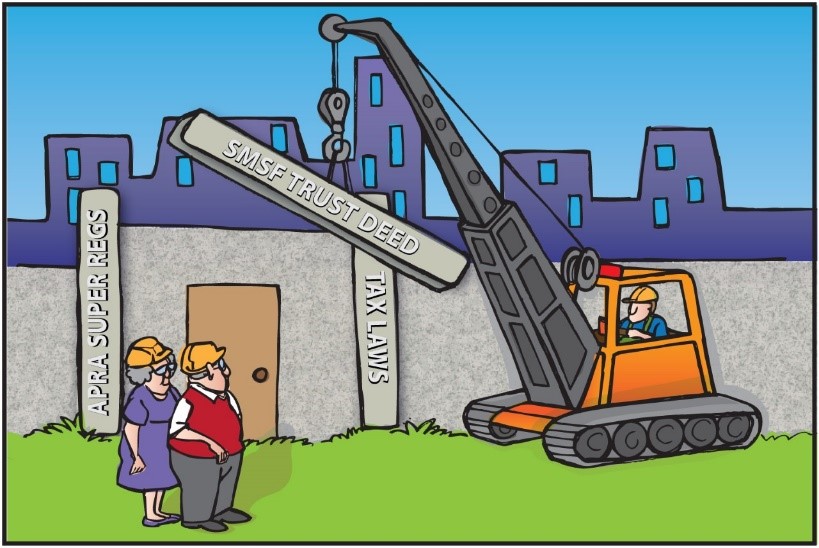

SMSF SERVICES

self managed super fund members and trustees

- In establishing their own super fund,

- providing an administration service that takes the work and worry out of the paperwork and compliance requirements,

- Tax planning and retirement strategy advice, and

- Investment advice based on performance and fees and not kickbacks, commissions, or being allied with a product provider.

Administration and Compliance service

$1,900 to $3,900

Costs varies depending on number of investments and value of the fund. Annual service cost agreed at commencement.

Annual service includes;

- Providing an annual information checklist,

- Collating all information for completing annual accounts,

- Processing financial transactions

- Preparation of statutory annual accounts,

- Reporting on investment performance for the financial period,

- Providing report showing cost of investments and market value,

- Reviewing fund’s compliance on super and tax regulations,

- Cost of annual audit, and where applicable obtaining actuarial certificates, and

- Providing guidance to trustees on ensuring ongoing compliance.

Services and Fees for SMSF setup

Assisting in the formation of an SMSF including:

- Establishment of the deed,

- Formation of the corporate trustee,

- All documentation required as part of the formation process,

- Emailing documents for signing and lodging,

- Applying for an Australian Business Number and Tax File Number,

- Setting up the fund on the Class SMSF administration platform, and

- Provision of a digital copy of relevant documentation.

$1,265

Strategic tax and portfolio investment service

- Establishing changes in personal and investment circumstances,

- Advising on what tax planning and investment strategies are available and assisting in the implementation of them,

- Reviewing investment performance and recommending rebalance and changes of investment portfolio,

- An annual/bi-annual meeting discussing investment and tax planning recommendations,

- Provision of a Record of Advice covering the details discussed in your review meeting

- Cost of completing applications and assistance to implement recommendations based on an agreed cost.

The cost of an annual review ranges from $1650 for industry fund members with other investments under $100,000, up to $3950 for SMSFs members with investments of more than $1 million.

Half yearly from $2,650 up to $4,950.

Quarterly for self managed super fund members from $6000 up to $8000.